Issues

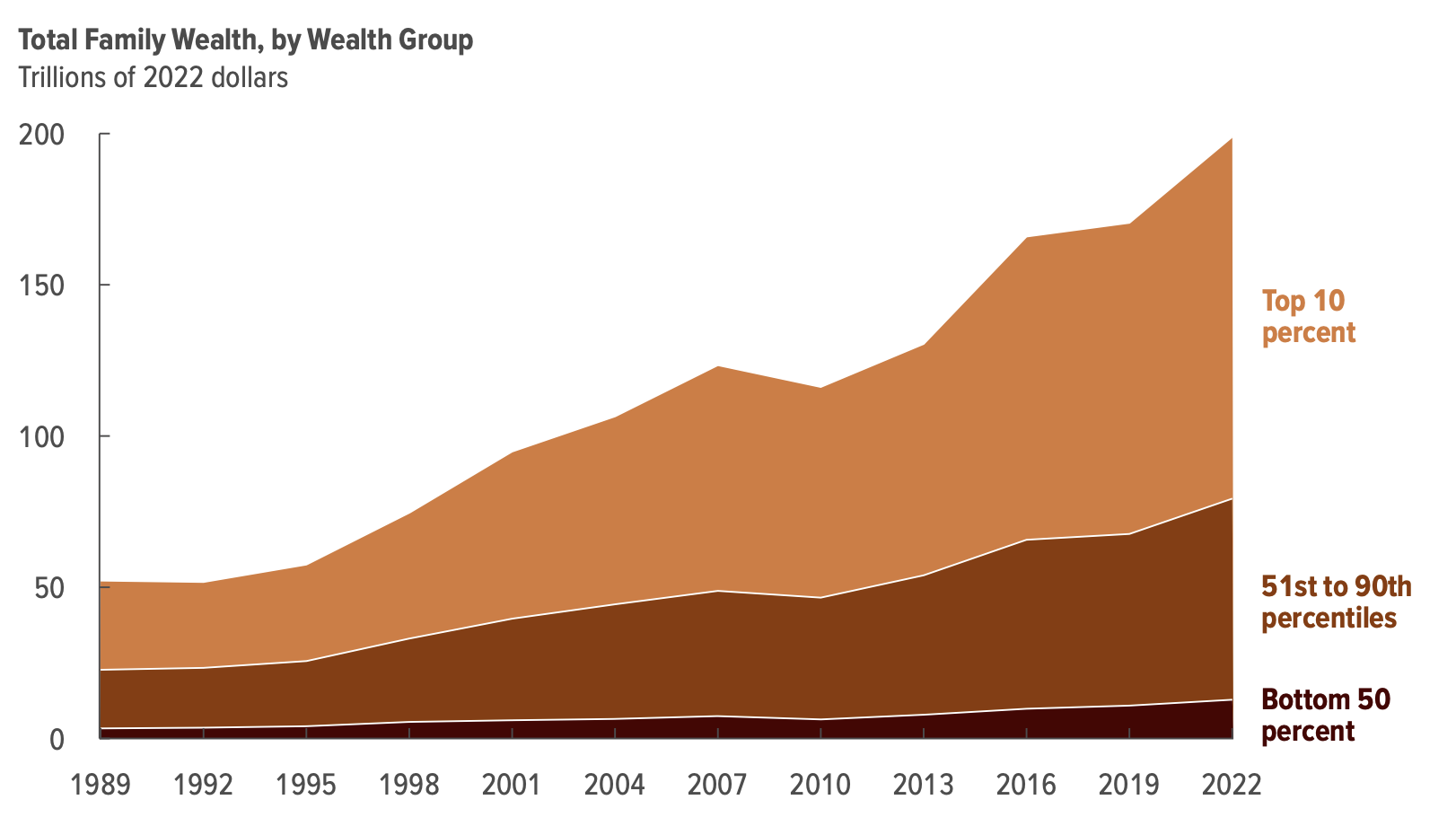

There was a time in this country when America made a promise to its citizens. It was not perfect, it was not for everyone, but it was a promise that millions of Americans could thrive through hard work and leave a better life for their children and grandchildren. A promise where a job could lead to owning a house and where an education leads to a real, sustainable retirement plan. However, this promise is fading and becoming increasingly difficult to keep. It’s not dying slowly or without anyone noticing, but it is happening right now. Our nation’s immense wealth is being concentrated in fewer hands at a speed that our grandparents could have never imagined. The ability to move up the ladder is not only decreasing, but it is disappearing completely. The power of the middle class is a fraction of what it once was, and we must reverse this situation before it worsens.

When too few hold too much, when opportunity becomes inheritance rather than achievement, when hard work ceases to matter, societies don’t just weaken, they crumble. This issue is not just about economics, and it is avoidable. This issue is truly about whether the America that once allowed for economic prosperity among the many can survive in an America that only allows for vast wealth among the few. When the center (and the center’s strength and ability to afford a meaningful life) collapses, so does our democracy. We are seeing the impact of our current corrupt system daily, and if we don’t change it soon, our nation will become unrecognizable.

Employee Fairness Doctrine

Lower the current 21% corporate tax rate (to around 18%) for companies capping CEO pay at 25× median worker salary

Higher rate (to around 28%) for companies exceeding this threshold

Generates billions while incentivizing fair pay structures

2. Progressive Surtax on Ultra-High Earners

2–3% surtax on income above $10 million

5% surtax on income above $50 million

1% annual wealth tax on billionaires

Addresses wealth concentration at the very top

Policy Solution

3. Update the Federal Estate Tax

Lower exemption threshold from $13.99 million to $3.5 million per individual

Progressive rates: 45% to 65% based on estate value

Close loopholes allowing vast tax-free generational wealth transfer

Immediate family members (spouses and children) receive a modest exemption of $1 million per beneficiary before taxes apply

4. Reduce Taxes on Desirable Activities

Lower middle-income ($47,150 to $191,950) tax rates by 2–3 percentage points

$5,000 first-time homebuyer tax credit

Eliminate the Social Security payroll tax cap above $176,100

Fully funded by revenue from the above three policies